-

By Code 9 Group

- In Corporate Tax Advisory

Different Types of Corporate Tax in Abu Dhabi

Abu Dhabi is a key business center in the United Arab Emirates, which qualifies it as one of the top destinations of entrepreneurs and multinationals. But increased size also means they must comply with tax laws. The implementation of the federal corporate tax and the further retention of the sectoral-related taxes have necessitated the need of business to hire the advice of some experienced tax consultants specializing in Abu Dhabi, or in other words, some unique corporate tax consultants in UAE. These experts help their clients stay compliant with the law while also taking advantage of opportunities to reduce their tax burden legally. The corporate tax in Abu Dhabi is not intended to be a one size system. The kind and rate charged on a business is subject to various factors such as industry, location of operation, structure of owners and amount of revenue generated. Engaging with the best tax consultants in UAE may serve as a strategic advantage to companies wishing to avoid fines and improve taxation.

Corporate Tax Sector Specific

Abu Dhabi has one of the most important corporate tax categories which target chosen industries like oil and gas and foreign-based banking organizations. Such industries attract elevated rates of tax rates because of their profitability and ability to have a strategic position in the economy. Tax rates can go as high as 55 percent imposed on oil and gas companies and about 20 percent on foreign banks. Companies in these industries have to engage the experience of the tax professionals like tax consultant Abu Dhabi or corporate tax consultants in Dubai to openly face the intricate rules and regulations, get ready proper records and avail any possible exemptions or reliefs. Instead of sole reliance on expertise, companies face a risk of overpaying taxes or getting insufficient comply.

Federal Corporate Tax for General Businesses

The UAE has applied a federal corporate tax across other business activities outside the oil, gas and foreign banking sectors. This taxation system is used when profits are above a prescribed amount and is charged a normal tax rate which is 9%. Such a shift brings the UAE in line with the international tax standards, making it more transparent, but not less attractive to investors abroad. Reading about these rules in detail is guaranteed through the help of a tax consultant Dubai. Whether calculating deductible income or claiming exemptions and submitting returns promptly, the work of professionals is safe and more cost-effective.

Corporate Tax Free Zones, Abu Dhabi

The tax incentives of Abu Dhabi free zones, including Khalifa Industrial Zone (KIZAD) and Abu Dhabi Global Market (ADGM) are not new. Free zone companies will, however, have to satisfy some conditions in order to continue enjoying these benefits taking into account new regulations. Such as taxation between income generated by trading with the mainland and income by international trade can be treated differently. Most companies undergo tax professionals services to keep compliant but take advantage of these incentives by seeking the services of tax consultancy in UAE firms. These professionals assist in shaping operations in a manner that complies with legal provisions whilst maintaining tax benefits and therefore they are valuable partners of free zone businesses.

The Role of Professional Tax Consultants

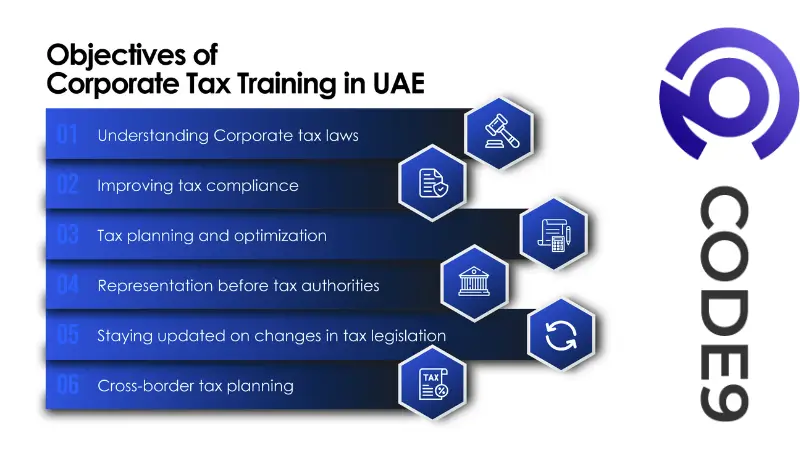

Corporate tax laws are changing in a land where legal proceedings have become the order of the day, and not a luxury. A tax consultant in Abu Dhabi or Dubai has the duty to offer a mixture of services such as compliance checks, tax planning, booking aids and representation in the case of audit. Knowledge of both the federal and local law guarantees businesses are functioning within the limits of the law, as they maximize the monetary performance. Corporate tax consultants in UAE are also instrumental in cross-border transactions, mergers and acquisitions which are aspects where tax can have a substantial impact. They also make businesses prepare in advance, by determining their possible liabilities and packaging transactions in a certain way that firms are not caught unawares.

Improve your Business with Code9Group

Going through the corporate tax structure in Abu Dhabi does not have to be daunting. The right partner will make compliance much easier, maximize your tax advantage, and build a successful business in a competitive market and economy in the UAE. Contact Code9Group and get in touch with qualified professionals whose experience and specialization in offering quality and customized tax solutions sees your business maintain its edge.

Final Words

Corporate tax in Abu Dhabi depends on adjusting the industry, place, and mode of doing business. There are sector-specific taxation on oil and gas, taxes on general businesses at federal corporate level, and optional considerations to free zones and the like. The idea is to work with recognized corporate taxation advisers in the United Arab Emirates in Dubai or Abu Dhabi to keep businesses aligned, reduce risks and do strategic planning towards sustainable development.