-

By Code 9 Group

- In Clinical Costing

Ultimate Guide To Corporate Tax Benefits for Small Businesses in UAE

Say goodbye to the traditions of the global financial environment, it is no longer a strategic choice to know all the benefits of the tax regime in the UAE but a crucial necessity. If it is VAT implications, or improved corporate tax advisory business opportunities, small enterprises are keen to engage the advice to ensure that they remain compliant and competitive. Luckily, the UAE provides various tax advantages, the effective use of which leads to growth, sustainability, and profitability.

Learning about Corporate Tax in UAE

UAE has historically enjoyed a tax-free environment and park, but the storyline has changed. The UAE government has implemented corporate income tax policies to increase levels of transparency and profit shifting in line with international tax regimes. As they may appear drastic to the businesses, namely, the small and mid-sized businesses, they are organized to benefit rather than harm the business, primarily through keeping the tax rates down, and providing numerous allowances and incentives. With companies using search engines to find their business tax consultant near me or a Small Businesses in UAE it has never been a better time to realize how specialist expertise can unlock value in this evolving tax system.

Friendly Taxation to Small Business Framework

Support for the smaller businesses is one of the things that makes the tax changes in the UAE the most encouraging. The thresholds and exemptions provided in the new tax regime, specifically to safeguard the micro and small companies, are highlighted by their respective firms of small business tax consultants. Often, corporations under a particular limit in revenue limit could enjoy zero taxation. This is why more and more business owners use the services of consultations with the help of searches like small business tax consultant near me. These tax benefits can strategically be utilized as either a sole proprietor or as a fast-growing SME with the assistance of the correct advisors.

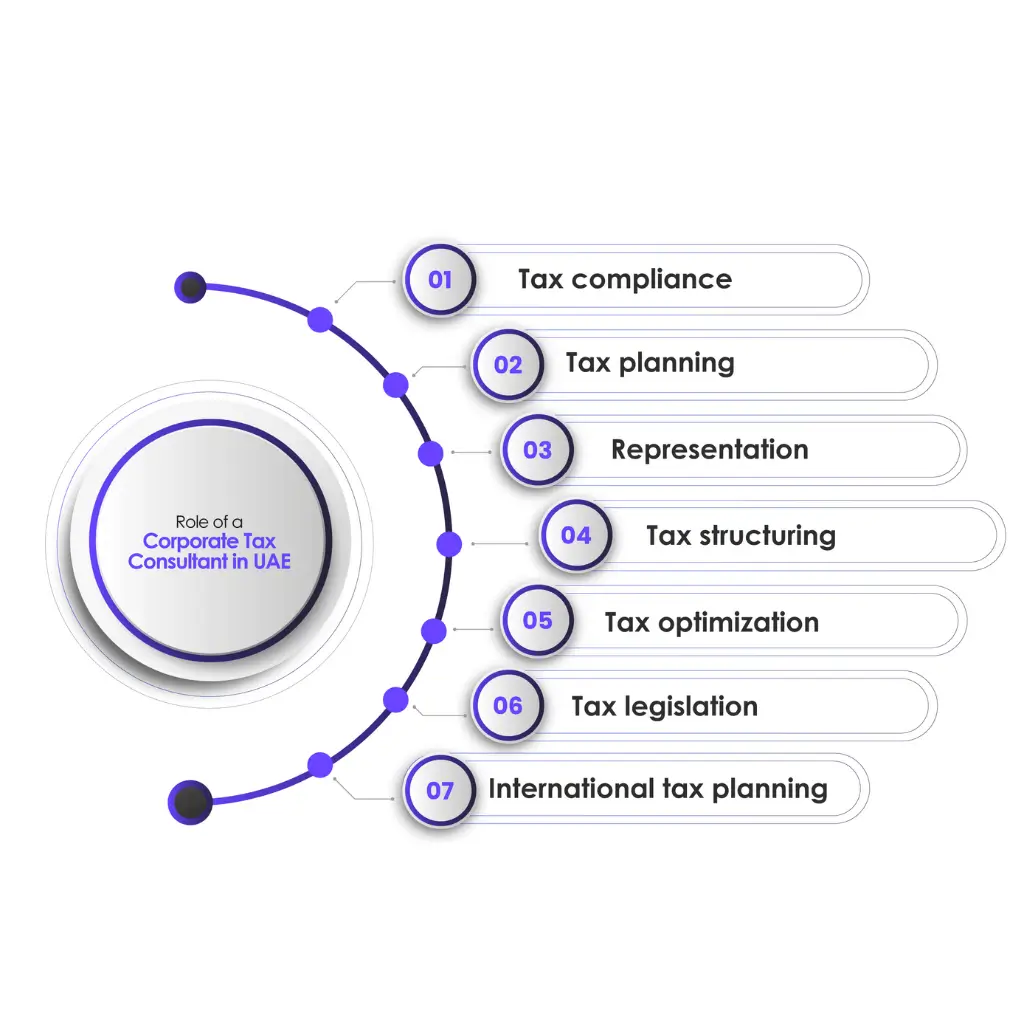

Corporate Tax Advising is Valuable

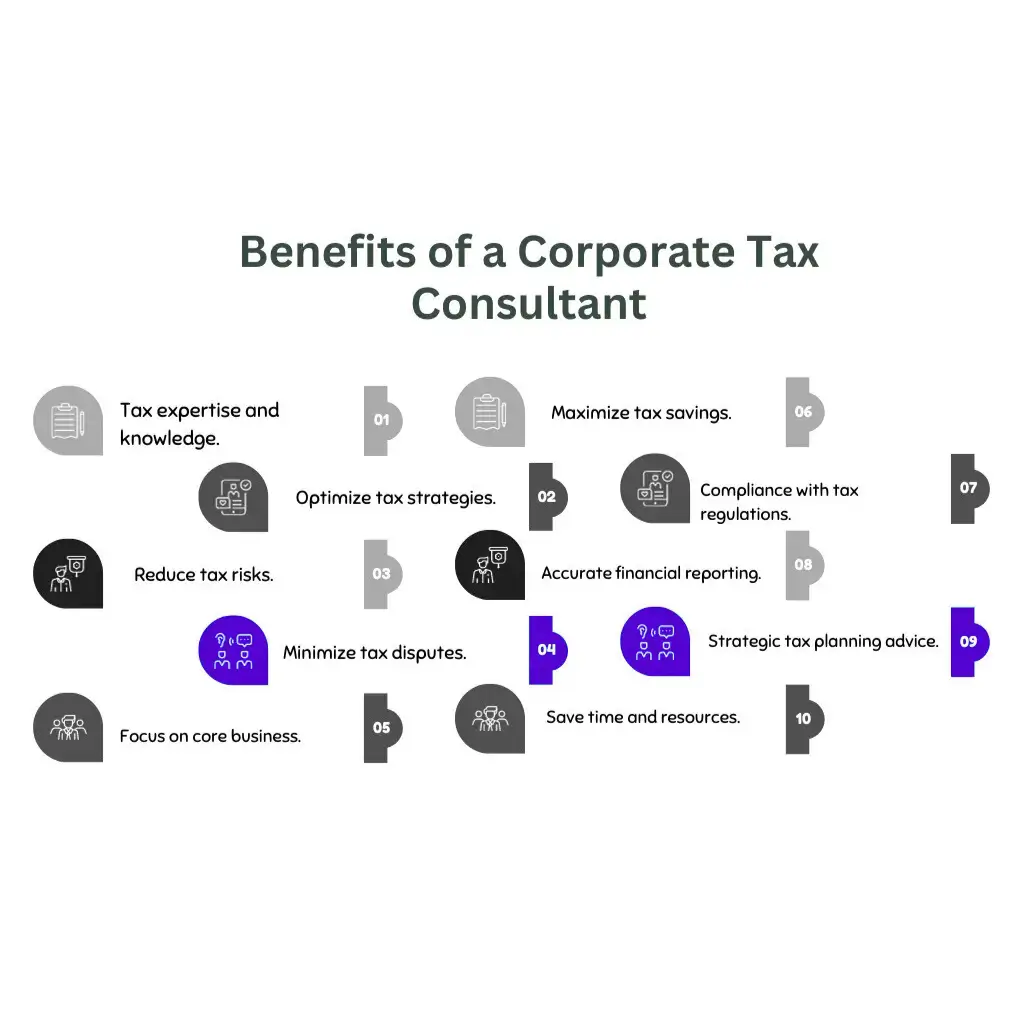

Involving in the services of corporate tax advisory does not merely involve compliance but ensuring that the business gets future-proof as well. The tax laws are dynamic and any business without the help of a company tax consultant who is abreast with the laws and the trend in taxation in other parts of the world is likely to be missing major deductions, incentives, and even changes in regulations. Corporate tax advisory also assists in finding the most effective entity structures, in keeping correct records of the deductible expenditure, and in facilitating documentation associated with filing to minimize errors and penalty levies. Tax advisory services of business are not expenses to businesses that are planning to prosper in the long-term perspective.

Dubai and Beyond VAT and Corporate Tax

Entrepreneurs are quite active in the emirate and in this case VAT corporate tax Dubai presentations are widely placed. Tax applies differently across all sectors including logistics, retail and services. As VAT is a separate but another important part of the taxation system, its interaction with the corporate tax rules makes professional advice even more important. Utilizing a team that is experienced in providing VAT & Corporate Tax Advisory services will mean that compliance requirements of businesses will be met in both fields and maximization of their tax positions achieved. In companies that deal with more than one emirate or even international markets, this forms part of sustainable operations.

How to Select a Tax Consultant?

Large enterprises are no longer limited to hiring a business tax consultant. More startups and small businesses, in fact, are focusing on relationships with what are called private business tax and advisory firms and they provide industry-specific services and they are highly client-focused. A good corporate tax consultant does not simply crunch numbers– but an individual that helps you plan your finances in regard to long term goals of the business. Whether it is the end-to-end business tax consulting services or simply a yearly reporting assistance, a trusted advisor can help minimize your risk and maximize your savings and help you gain confidence in making decisions. Using the most favorable legal structure to working out of a most effective tax position, a professional consultant who has built up substantial experience in a field illuminates complexity. Most of the best advisors also know the technology, and they can use digital platforms to improve the accuracy of reporting and improve communications and making it easier to let you focus on growth and leave the tax aspect of your financial dealings in the good hands of your advisory side.

Are You Ready to Maximize Your Tax?

When you are a small business owner in the UAE and want to make sure that you are complying with all regulations, but also want to gain as many benefits as possible, Code9Group can help you in this endeavor through expert-led on-demand services in the form of customized services named on their website, VAT & Corporate Tax Advisory. If you need a tax consultant for the company or a long-term business advisor for taxation services, our team will be happy to help your financial management goals, clearly and confidently. Contact Code9Group and make an appointment with our reliable corporate tax specialists and make ensure that your business is financially secure, in a smart and legal way.

Conclusion

The myth that it is only big companies that should utilize tax planning is dated. Small businesses are particularly prone to suffer loss of finances and even minor fines or forfeiture to incentives may have a significant impact. As tax reporting is becoming more stringent and tracked in the UAE, the sooner you initiate a corporate tax plan, the better concretely your business will be to grow and flex. Additionally, structured tax planning also helps small businesses because it makes their finances far tighter and opportune. The collaboration with a tax consultant of the small business type or the consideration of corporate tax consultancy services is beneficial to establishing good financial habits, determining the potential deductions, and predicting future commitments accurately.